The Main Principles Of Mortgage Broker Melbourne

Table of ContentsThe smart Trick of Melbourne Mortgage Broker That Nobody is DiscussingThe 6-Second Trick For Mortgage Broker Review

It is guessed that, because consumers' applications are stress-tested on the stamina of their capacity to make the regular monthly repayments, boosting numbers of debtors are choosing home mortgage terms exceeding the typical 25 years. This results in lower settlements but a higher total passion bill, in addition to a longer duration servicing financial obligation.

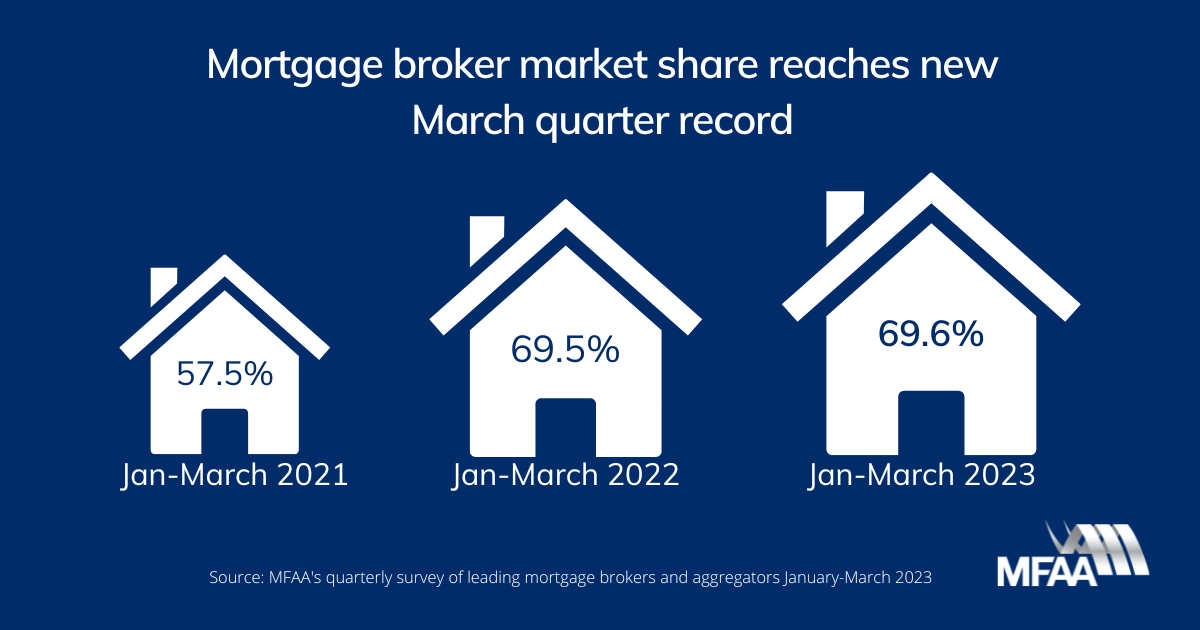

Home loan brokers have been active in Australia considering that the very early 1980s, nevertheless they just ended up being a dominant pressure in the mortgage sector during the late 1990s on the back of aggressive advertising by Aussie Home Loans. mortgage broker melbourne and Wizard Home Loans. Around 35% of all car loans protected by a home loan in Australia were introduced by Discover More home loan brokers in 2008.

In 20162017, home mortgage brokers had actually added to $2. 9 billion to Australian economic climate. In 2019, the Home loan Broker market share has grown to 59% of the home mortgage market, however, the future viability of the field has actually been cast into doubt due to suggestions of the Hayne Royal Payment. Commissioner Hayne has actually advised that loan providers stop paying upfront and routing commission to Brokers and rather, that the customer pays a yet-to-be identified in advance charge for solution.

The Only Guide to Best Mortgage Brokers Melbourne

On the occasion that the car loan is repaid by the customer within 24 months of the financing settlement, home loan brokers are billed a "clawback" cost by the lenders because the funding is considered "unprofitable". my latest blog post The amount is generally 0. 66% of the lending amount for finances repaid in the initial year and 0.